Menu

Medical Debt in LA County

Medical Debt in LA County

- The amount of medical debt was estimated to be over $2.9 billion in LA County in 2023.

- The percentage of adults burdened by medical debt is similar to those with type 2 diabetes and greater than those with asthma.

- Medical debt disproportionately affects families with children, lower-income, Latino, Black, American Indian, and Pacific Islander residents, and people with chronic health conditions.

- For many individuals and families, medical debt leads to physical and mental health problems, and financial instability. Even with insurance, healthcare costs can add up quickly and lead to significant debt.

- The debt can make it difficult to pay for basics like food and housing and can lead people to skip or delay needed medical care.

For more information, see the Medical Debt in LA County report, May 2025 (Spanish)

Preventing and Reducing Medical Debt

In June 2023, Public Health published a 2021 Baseline Report and Action Plan on Medical Debt in Los Angeles County that showed the scale and impact of the problem. View report:

English I

Spanish. The data was updated in the 2024 (English I

Spanish) and 2025 (English

I

Spanish) reports.

Informed by the baseline report, on October 3, 2023, the LA County Board of Supervisors approved the motion

Reducing Medical Debt in Los Angeles County though improved data collection and innovative strategies to retire Medical Debt. The motion directed several County departments to work together to address this important issue.

Press release: Board Approves Hahn-Mitchell Proposals to Reduce Medical Debt for Local Families

Below are our priority areas and the progress we have made on each.

Expand All

Our goal is to collect, and make public, data on healthcare facilities’ debt collection and financial assistance activities. This will increase transparency for healthcare systems, local government, and community stakeholders and allow for tracking progress.

Los Angeles County Ordinance: Addressing Medical Debt Through Data Collection

Press release: Supervisors Approve Ordinance to Require Hospitals to Report Medical Debt Data

As of April 29, 2025, the Los Angeles City Council unanimously passed a motion directing the Los Angeles City Attorney to draft and present an ordinance to the Council that will incorporate Los Angeles County's Addressing Medical Debt Through Data Collection Ordinance. The motion was authored by District 1 Councilmember Eunisses Hernandez and co-sponsored by District 6 Councilmember Imelda Padilla and will extend the data reporting requirements of the County's ordinance to the 34 acute care hospitals in the City of Los Angeles.

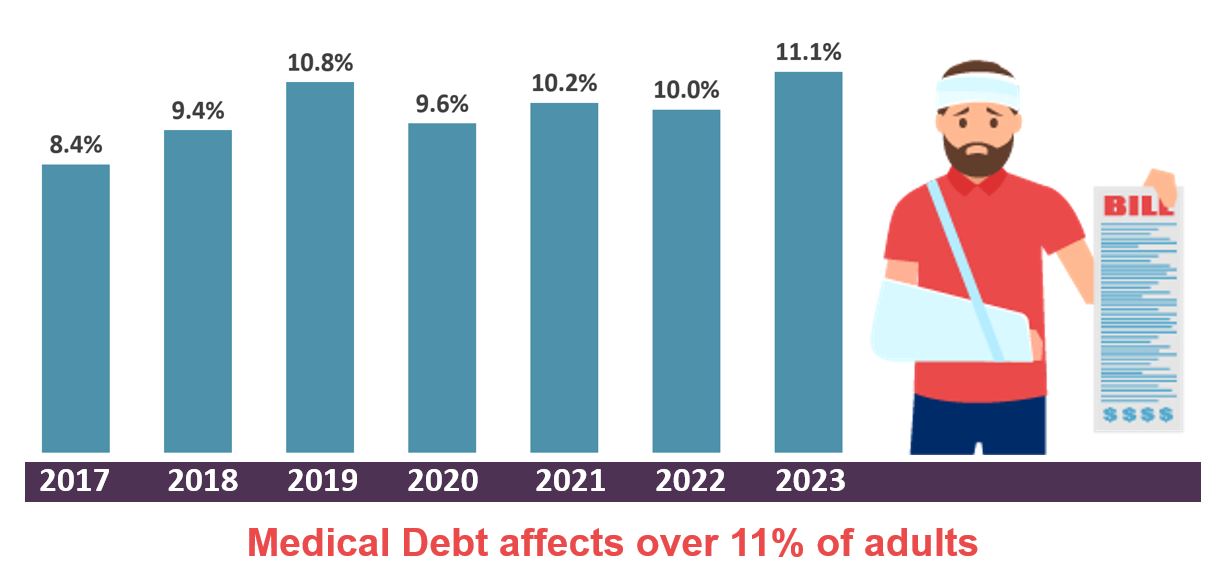

Ongoing Surveillance

In January 2024 and May 2025, Public Health published updates to the baseline Medical Debt report. The 2025 report showed that the medical debt burden in LA County increased to affect 1 in 9 adults. The total medical debt burden remained high and was estimated to be greater than $2.9 billion in 2023.

The reports are based on data from the UCLA California Health Interview Survey (CHIS). We have developed additional questions on medical debt to help us better understand sources of medical debt and how the debt impacts LA County residents in the future.

Our goal is to maximize the benefit of existing financial assistance resources for patients, including hospital financial assistance programs. We’re working to simplify and clarify applications, improve eligibility assessment and prescreening, and qualify patients for financial assistance early and for a sufficient duration to reduce the burden on healthcare systems and improve patient experience.

In September 2025, Public Health released a comprehensive report on hospital financial assistance practices in LA County. In addition, the Financial Assistance Best Practices Committee released its recommendations for hospital financial assistance programs, including the adoption of a model application and policy. Press release: Los Angeles County Releases Landmark Report on Hospital Charity Care and Launches New Tools to Expand Access to Financial Assistance

Landscape of Financial Assistance

Hospital financial assistance programs are important for preventing medical debt and are legally required in the state of California.

The purpose of the Landscape of Hospital Financial Assistance in Los Angeles County report

is to illustrate trends in hospital financial practices and areas of improvement and to inform targeted interventions to better protect consumers from financial harm.

Best Practices in Financial Assistance

Click here to review the Best Practices for Hospital Financial Assistance Programs.

Model Application and Policy

One identified Best Practice recommendation is for hospitals to use a uniform, accessible financial assistance application that works for both patients and providers across the county. To support adoption, Public Health and the Best Practices Committee created adaptable model documents. Review the complete toolkit here or the individual components below.- Model Application (pdf I docx)

- Model Plain Language Summary (pdf I docx)

- Model Financial Assistance Policy (pdf I docx)

Presumptive Eligibility to Expedite Qualification

Our goal is to purchase medical debt for low income LA County residents and retire it. This intervention will reduce the financial burdens, improve mental health, and remove healthcare access barriers for hundreds of thousands of residents.

Our overall goal is to relieve $2 billion of medical debt so that, in addition to long term reform, we can make a meaningful difference in the lives of hundreds of thousands of LA County residents who are burdened by medical debt. We are hopeful that our philanthropic partners, hospitals, and health plans will be able to complement the County’s effort.

The pilot program, which is in partnership with the national non-profit Undue Medical Debt, was launched on December 16, 2024. Residents started to receive letters to say their debt was canceled in May 2025 and, as of December 1, 2025, over $363 million of medical debt has been erased for over 171,000 residents.

Press releases:

- 6.24.24: LA County will Launch Pilot Program to Eliminate Low-Income Residents’ Medical Debt.

- 12.16.24: Public Health Launches Los Angeles County Medical Debt Relief Program - L.A. County and Partners Seek to Relieve $2 Billion in Medical Debt.

- 5.15.25: Over 134,000 LA County Residents Will Receive Notices of Medical Debt Relief.

- 12.2.25: Over $363 Million in Medical Debt Relieved for Low-Income Los Angeles County Residents.

We work with a strong multi-sector coalition to address medical debt as a systemic health issue and sustain focused action on medical debt.

The Los Angeles Medical Debt Coalition

Summits on Medical Debt

Working groups have been formed to develop and promote strategies to reduce and prevent medical debt:

LA County and Public Health advocate for policy changes that prevent medical debt, reduce its burden, and promote consumer protection and fair billing practices.

LA County and Public Health advocacy efforts to date include:

- Support for the Patient Medical Debt Prevention Act: CA AB-1312 (enacted on 10/7/25): This law will take effect on 1/1/27 and will require hospitals to proactively screen patients for free or discounted care and apply financial assistance before billing, protecting uninsured, low-income, and homeless patients from medical debt.

- Support for the Consumer Debt: Medical Debt bill CA SB-1061 (enacted on 9/24/24): The law, which took effect on 1/1/25 removes medical debt from credit reports and prohibits debt collectors from reporting patients’ medical debt information to credit agencies. According to the California Attorney General in November 2025, SB 1061 is fully in effect. It is illegal for medical debt to appear on credit reports.

- Support for the Hospital and Emergency Physician Fair Pricing Policies bill CA AB-2297 (enacted on 9/24/24). This law, which took effect on 1/1/25, clarifies the definitions of charity care and eligibility reviews, bans home liens for eligible patients, allows all cost-sharing deductions, and removes asset considerations. See fact sheet summarizing the bill.

- Recommendations to the California Department of Health Care Access and Information (HCAI) on their Notice of Proposed Rulemaking regarding changes to the Hospital Community Benefits Plan Reporting Program. The changes are intended to strengthen reporting requirements.

- Recommendations to the Federal Consumer Financial Protection Bureau (CFPB) proposal to amend the Fair Credit Reporting Act to remove medical debt from credit reports.

Acknowledgements

The Department of Public Health gratefully acknowledges the support of The California Endowment, The California Wellness Foundation, and The California Health Care Foundation for their contributions to this initiative.